HDB households to receive S$45m in utilities rebates in Oct 2013

POSTED: 30 Sep 2013 13:29

Some 800,000 Singaporean HDB households are to receive S$45 million worth of GST Voucher rebates in October 2013. The rebates come under the Utilities Save (U-Save) category and are used to offset the utilities expenses of households.

SINGAPORE: Some 800,000 Singaporean HDB households are to receive S$45 million worth of GST Voucher rebates in October 2013. The rebates come under the Utilities Save (U-Save) category and are used to offset the utilities expenses of households.

In statement released on Monday, the Finance Ministry said eligible households will each receive a voucher of S$45 to S$65, depending on their HDB flat type.

However, households whose members own more than one property are not eligible for the GST Voucher - U-Save vouchers.

The GST Voucher - U-Save is the household component of the permanent GST Voucher scheme that was introduced in Budget 2012.

It is paid out four times in the year -- July 2013, October 2013, January 2014 and April 2014.

- CNA/ac

- wong chee tat ):

Monday, September 30, 2013

JEM to re-open on Oct 2

JEM to re-open on Oct 2

POSTED: 30 Sep 2013 13:49

JEM shopping mall is expected to re-open this Wednesday after being closed for almost a fortnight.

SINGAPORE: JEM shopping mall is expected to re-open this Wednesday after being closed for almost a fortnight.

In a post at its Facebook page on Monday morning, the mall's management said it will welcome shoppers and diners from 10am on Wednesday.

The mall was closed on September 19 after a water pipe burst.

The burst pipe had caused part of the ceiling on the first floor to collapse.

- CNA/ac

- wong chee tat :)

POSTED: 30 Sep 2013 13:49

JEM shopping mall is expected to re-open this Wednesday after being closed for almost a fortnight.

SINGAPORE: JEM shopping mall is expected to re-open this Wednesday after being closed for almost a fortnight.

In a post at its Facebook page on Monday morning, the mall's management said it will welcome shoppers and diners from 10am on Wednesday.

The mall was closed on September 19 after a water pipe burst.

The burst pipe had caused part of the ceiling on the first floor to collapse.

- CNA/ac

- wong chee tat :)

Demand for printed books still strong in India despite global decline

Demand for printed books still strong in India despite global decline

By Avneet Arora

POSTED: 30 Sep 2013 17:30

Printed books are seeing a decline in the West as more people turn to digital books or e-books, but in India, the printed word is still king.

INDIA: Printed books are seeing a decline in the West as more people turn to digital books or e-books.

But in India, the printed word is still king.

And this is prompting international publishers to venture into the country, which is the world's third largest English-language book market.

While the e-book explosion has led to the closure of bookstores in many parts of the world, the book market in India has shown a remarkable resilience.

Experts believe the trend is here to stay for some time.

Dr Ashok Gupta, general secretary at the Federation of India Publishers, said: "Growth potential is very high -- that means for another 50 to 100 years, we can continue to grow in the educational sectors… the market is so big.

“With GDP growth and with the educational sectors, government investments are increasing day by day. I hope and I am 100 per cent sure that this sector will continue to grow."

Market observers point to several reasons for the industry's growth -- rising literacy levels, an increase in English-speaking Indians, the sudden spurt in regional and national level literature festivals and the aggressive promotional techniques adopted to promote book sales.

The market is so bullish, more foreign publishers are investing millions of dollars to set up shop in India.

Tridip Chatterjee, secretary at the Publishers and Booksellers Guild, said: "(To produce) Indian books for the Indian market, so many multinational publishing companies have already started their own house, their own publishing unit in India.

“Like Random House, Elsevier, they have their own publishing hub in Noida, in Gurgoan because it's a huge market and the book market in India is expanding."

Experts believe the country's own publishing industry needs to work a lot harder to cash in on the current boom.

Dr Gupta said: "We need to have more book fairs and such events in each city -- towns, villages, everywhere."

Books have been man's best friend for several centuries, and despite threats from digitised mediums, it seems in India at least, it will take a while for anything to replace the crisp, printed, tightly bound book.

For the moment, this sentiment is keeping both publishing houses and book lovers happy.

- CNA/nd

- wong chee tat :)

By Avneet Arora

POSTED: 30 Sep 2013 17:30

Printed books are seeing a decline in the West as more people turn to digital books or e-books, but in India, the printed word is still king.

INDIA: Printed books are seeing a decline in the West as more people turn to digital books or e-books.

But in India, the printed word is still king.

And this is prompting international publishers to venture into the country, which is the world's third largest English-language book market.

While the e-book explosion has led to the closure of bookstores in many parts of the world, the book market in India has shown a remarkable resilience.

Experts believe the trend is here to stay for some time.

Dr Ashok Gupta, general secretary at the Federation of India Publishers, said: "Growth potential is very high -- that means for another 50 to 100 years, we can continue to grow in the educational sectors… the market is so big.

“With GDP growth and with the educational sectors, government investments are increasing day by day. I hope and I am 100 per cent sure that this sector will continue to grow."

Market observers point to several reasons for the industry's growth -- rising literacy levels, an increase in English-speaking Indians, the sudden spurt in regional and national level literature festivals and the aggressive promotional techniques adopted to promote book sales.

The market is so bullish, more foreign publishers are investing millions of dollars to set up shop in India.

Tridip Chatterjee, secretary at the Publishers and Booksellers Guild, said: "(To produce) Indian books for the Indian market, so many multinational publishing companies have already started their own house, their own publishing unit in India.

“Like Random House, Elsevier, they have their own publishing hub in Noida, in Gurgoan because it's a huge market and the book market in India is expanding."

Experts believe the country's own publishing industry needs to work a lot harder to cash in on the current boom.

Dr Gupta said: "We need to have more book fairs and such events in each city -- towns, villages, everywhere."

Books have been man's best friend for several centuries, and despite threats from digitised mediums, it seems in India at least, it will take a while for anything to replace the crisp, printed, tightly bound book.

For the moment, this sentiment is keeping both publishing houses and book lovers happy.

- CNA/nd

- wong chee tat :)

Assisi Hospice to raise funds for operating expenses shortfall

Assisi Hospice to raise funds for operating expenses shortfall

POSTED: 30 Sep 2013 01:01

The Assisi Hospice held a charity dinner on Sunday to raise funds to meet their operating expenses shortfall.

SINGAPORE: The Assisi Hospice held a charity dinner on Sunday to raise funds to meet their operating expenses shortfall.

It targets to raise $900,000 to meet their expenses shortfall of $5 million for their current 37-bedded hospice.

The organisation is also building a new hospice.

A ground-breaking ceremony was held on 29 July 2013, and the expected completion date for the new 85-bedded facility will be in 2016.

Acting Manpower Minister Tan Chuan-Jin, who graced the ceremony, stressed the importance of giving back to society - especially to elderly.

While financial support is important to facilitate the work that needs to be done, he said it's crucial that Singapore builds a society that gives.

These values can be harnessed when Community Involvement Programmes in schools and Corporate Social Responsibility at workplaces are done with the right spirit.

Mr Tan added that the Government can provide social safety nets but there are some roles that it can't play. And this is where citizens can step in and help the less fortunate by contributing their time and effort, which will in turn help to build a more caring society.

- CNA/de

- wong chee tat :)

POSTED: 30 Sep 2013 01:01

The Assisi Hospice held a charity dinner on Sunday to raise funds to meet their operating expenses shortfall.

SINGAPORE: The Assisi Hospice held a charity dinner on Sunday to raise funds to meet their operating expenses shortfall.

It targets to raise $900,000 to meet their expenses shortfall of $5 million for their current 37-bedded hospice.

The organisation is also building a new hospice.

A ground-breaking ceremony was held on 29 July 2013, and the expected completion date for the new 85-bedded facility will be in 2016.

Acting Manpower Minister Tan Chuan-Jin, who graced the ceremony, stressed the importance of giving back to society - especially to elderly.

While financial support is important to facilitate the work that needs to be done, he said it's crucial that Singapore builds a society that gives.

These values can be harnessed when Community Involvement Programmes in schools and Corporate Social Responsibility at workplaces are done with the right spirit.

Mr Tan added that the Government can provide social safety nets but there are some roles that it can't play. And this is where citizens can step in and help the less fortunate by contributing their time and effort, which will in turn help to build a more caring society.

- CNA/de

- wong chee tat :)

Private resale home prices up 0.1% in August: SRPI

Private resale home prices up 0.1% in August: SRPI

POSTED: 30 Sep 2013 14:48

Prices of private resale homes rose just 0.1 per cent in August from July -- this is according to the latest Singapore Residential Price Index (SRPI), which tracks prices of completed private apartments and condominiums.

SINGAPORE: Prices of private resale homes rose just 0.1 per cent in August from July -- this is according to the latest Singapore Residential Price Index (SRPI), which tracks prices of completed private apartments and condominiums.

The SRPI data is published by the Institute of Real Estate Studies at National University of Singapore (NUS).

Resale prices of private homes in the central area saw the biggest decline, down 1.1 per cent last month.

However, prices of units in the non-central region went up by 1.0 per cent. The index covering small units of 506 square feet and below also increased 1.0 per cent.

- CNA/ac

- wong chee tat :)

POSTED: 30 Sep 2013 14:48

Prices of private resale homes rose just 0.1 per cent in August from July -- this is according to the latest Singapore Residential Price Index (SRPI), which tracks prices of completed private apartments and condominiums.

SINGAPORE: Prices of private resale homes rose just 0.1 per cent in August from July -- this is according to the latest Singapore Residential Price Index (SRPI), which tracks prices of completed private apartments and condominiums.

The SRPI data is published by the Institute of Real Estate Studies at National University of Singapore (NUS).

Resale prices of private homes in the central area saw the biggest decline, down 1.1 per cent last month.

However, prices of units in the non-central region went up by 1.0 per cent. The index covering small units of 506 square feet and below also increased 1.0 per cent.

- CNA/ac

- wong chee tat :)

Yahoo! Asia Pacific pay damages to SPH in copyright infringement suit

Yahoo! Asia Pacific pay damages to SPH in copyright infringement suit

By Vimita Mohandas

POSTED: 30 Sep 2013 20:31

Yahoo! Asia Pacific has paid damages and costs to Singapore Press Holdings (SPH) in a copyright infringement suit.

SINGAPORE: Yahoo! Asia Pacific has paid damages and costs to Singapore Press Holdings (SPH) in a copyright infringement suit.

This was revealed in a joint media statement on Monday.

The settlement amount was not stated.

Under the terms of the amicable settlement, Yahoo! Asia Pacific has acknowledged that it has reproduced content from SPH's newspapers on its Yahoo! Singapore News site without SPH's approval.

The responsible employees have been disciplined or terminated.

The statement mentioned that Yahoo! companies strive to respect the intellectual property rights of others wherever they do business.

In November 2011, SPH filed a lawsuit against Yahoo, citing 23 articles from which Yahoo had substantially reproduced content without permission.

Yahoo then countersued SPH in December 2011, citing two articles and a picture allegedly posted on SPH's website Stomp as infringement of its copyright.

In August last year, SPH filed an amended claim, citing a total of 254 articles stretching over 17 months, which it said Yahoo had reproduced without permission.

- CNA/fa

- wong chee tat :)

By Vimita Mohandas

POSTED: 30 Sep 2013 20:31

Yahoo! Asia Pacific has paid damages and costs to Singapore Press Holdings (SPH) in a copyright infringement suit.

SINGAPORE: Yahoo! Asia Pacific has paid damages and costs to Singapore Press Holdings (SPH) in a copyright infringement suit.

This was revealed in a joint media statement on Monday.

The settlement amount was not stated.

Under the terms of the amicable settlement, Yahoo! Asia Pacific has acknowledged that it has reproduced content from SPH's newspapers on its Yahoo! Singapore News site without SPH's approval.

The responsible employees have been disciplined or terminated.

The statement mentioned that Yahoo! companies strive to respect the intellectual property rights of others wherever they do business.

In November 2011, SPH filed a lawsuit against Yahoo, citing 23 articles from which Yahoo had substantially reproduced content without permission.

Yahoo then countersued SPH in December 2011, citing two articles and a picture allegedly posted on SPH's website Stomp as infringement of its copyright.

In August last year, SPH filed an amended claim, citing a total of 254 articles stretching over 17 months, which it said Yahoo had reproduced without permission.

- CNA/fa

- wong chee tat :)

Sunday, September 29, 2013

The moment a cheeky baboon groped shocked TV reporter's breast live on air... before giving the cameras a wide grin

The moment a cheeky baboon groped shocked TV reporter's breast live on air... before giving the cameras a wide grin

By Daily Mail Reporter

PUBLISHED: 18:30 GMT, 25 September 2013 | UPDATED: 21:25 GMT, 25 September 2013

A baboon made the most of his fifteen minutes of fame by grabbing a female reporter's breast live on air, before looking straight into the camera and giving it a wide grin.

Sabrina Rodriguez, who presents for Fox 40 in Sacramento, California, was shooting a teaser for a report on the Lodi Grape Festival on September 12 when the cheeky monkey seized his chance and clamped his paw on her right breast.

Ever the professional, Ms Rodriguez carried on her piece unruffled and attempted to make a joke of it, telling viewers, 'he's trying to cop a little bit of a feel'.

Scroll down for video

Going in for the grope: Reporter Sabrina Rodriguez manages to see the funny side as mickey the baboon cops a feel live on air

Cheeky monkey: Mickey the baboon clamps his right paw over the breast of Fox 40 reporter Sabrina Rodriguez live on camera for the entire report

But despite her best efforts, Mickey refused to remove his paw and, looking rather pleased with himself, continued groping her as she wrapped up the broadcast.

Keeping as straight a face as possible, she finished her segment with the sign off: "join us soon when we'll be learning a bit about why baboons like grapes'.

But seconds later he clambered behind her, put one paw on her shoulder and with the other seized his chance to go in for a grope, all while brazenly staring down the camera with a toothy grin.

Toothy grin: Mickey looks quite pleased with himself after groping Ms Rodriguez

Managing to keep her calm, albeit with a nervous giggle, Ms Rodriguez carried on her piece like a stalwart as the camera panned away from her face and the baboon's cheeky antics.

Later asked if the baboon was showing its teeth because it was mad or smiling, Rodriguez responded, "I'm gonna go with smiling."

Ms Rodriguez, 29, is an Emmy award winning TV news reporter and covers the north California area for Fox 40.

She was shooting a live trailer for her report on the Lodi Grape Festival, which ran from September 12 to 15 and featured a 'Wild About Monkeys' show.

The show aimed to show how social baboons are - something Mickey managed to get across quite well in his few seconds on screen.

Stars of the screen: Both Ms Rodriguez and Mickey the baboon have appeared before camera a number of times, however usually in a more dignified manner

Mickey, the star of the show, has already found international fame appearing next to Tom Cruise in the film Rock of Ages released in 2012.

According to the film's director, Tom Cruise was quite taken with the baboon who was just as cheeky on that set.

Adam Shankman told thewrap.com: "One day the baboon got loose, and he was running up and down the street yelling at extras. We had to stop for 20 minutes and wrangle him.

"Those are canines on that baby. He’s very sweet. Very sensitive. Tom Cruise did a scene where he was actually talking to the baboon — it’s not currently in the movie — and he had his face really, really close. Forehead to forehead. I was shivering. But the baboon loves him. Every day we wrapped, Tom would hug me and shake me and say, 'I am having the best time, thank you.'"

Star turn: Mickey the Baboon is no stranger to fame and the wild ways of Hollywood after appearing with Tom Cruise in the film 'Rock of Ages'

Read more: http://www.dailymail.co.uk/news/article-2432320/Baboon-gropes-shocked-TV-reporters-breast-live-shot-giving-cameras-wide-grin.html#ixzz2gIDpBwid

Follow us: @MailOnline on Twitter | DailyMail on Facebook

- wong chee tat :)

Baboon Gropes TV Reporter Live On Air - Sabrina Rodriguez

- wong chee tat :)

20130910一天一粒_多主題雜燴之換場景啦~~~~

- wong chee tat :)

Labels:

2013,

A Perfect Female Companion,

attractive,

Beautiful Day,

Beautiful Life,

beautiful women,

female,

females,

male,

males,

pretty,

sept,

鄭家純,

雞排妹

Saturday, September 28, 2013

Dell BIOS in some Latitude laptops and Precision Mobile Workstations vulnerable to buffer overflow

Vulnerability Note VU#912156

If you are a vendor and your product is affected, let us know.

This document was written by Adam Rauf.

- wong chee tat :)

Dell BIOS in some Latitude laptops and Precision Mobile Workstations vulnerable to buffer overflow

Original Release date: 15 Aug 2013 | Last revised: 22 Aug 2013

Print Document

Tweet

Like Me

Share

Overview

Dell BIOS in some older Latitude laptops and Precision Mobile Workstations are vulnerable to buffer overflows (CWE-119), which can bypass the signed BIOS enforcement standard.Description

| CWE-119: Improper Restriction of Operations within the Bounds of a Memory Buffer Dell BIOS in some older Latitude laptops and Precision Mobile Workstations is vulnerable to buffer overflows in the rbu_packet.pktNum and rbu_packet.pktSize values. These values can be set by an attacker while performing an illegitimate BIOS update. The BIOS reads these values when reconstructing the BIOS image, before any signature check occurs. More information is available from the BIOS Security presentation at Black Hat USA 2013. |

Impact

| By convincing a user with root or administrative privileges to execute a malicious BIOS update, an attacker can bypass the signed BIOS enforcement to install an arbitrary BIOS image that could contain a rootkit or malicious code that persists across operating system re-installations and official BIOS updates. |

Solution

| Apply an Update Dell has released updated BIOS versions for the affected Latitude and Precision systems that can be downloaded from their support site. Dell has provided the following list of fixed BIOS versions: Dell System Released Rev =================================================== Latitude D530 8/22/2013 A12 Latitude D531 7/16/2013 A12 Latitude D630 7/16/2013 A19 Latitude D631 7/26/2013 A12 Latitude D830 7/16/2013 A17 Precision M2300 7/16/2013 A11 Precision M4300 7/16/2013 A17 Precision M6300 7/16/2013 A15 Latitude E5400 7/16/2013 A19 Latitude E5500 7/16/2013 A19 Latitude E4200 7/16/2013 A24 Latitude E4300 7/16/2013 A26 Latitude E6400 7/16/2013 A34 Latitude E6400 ATG 7/16/2013 A34 Latitude E6400 / ATG / XFR 7/16/2013 A34 Latitude XT2 7/18/2013 A15 Latitude E6500 7/16/2013 A29 Latitude Z600 7/16/2013 A11 Precision M2400 7/16/2013 A28 Precision M4400 7/16/2013 A29 Precision M6400 7/16/2013 A13 Precision M6500 7/18/2013 A10 |

Vendor Information (Learn More)

| Vendor | Status | Date Notified | Date Updated |

|---|---|---|---|

| Dell Computer Corporation, Inc. | Affected | 11 Jul 2013 | 22 Aug 2013 |

CVSS Metrics (Learn More)

| Group | Score | Vector |

|---|---|---|

| Base | 6.2 | AV:L/AC:H/Au:N/C:C/I:C/A:C |

| Temporal | 4.9 | E:POC/RL:OF/RC:C |

| Environmental | 3.7 | CDP:ND/TD:M/CR:ND/IR:ND/AR:ND |

References

- https://www.blackhat.com/us-13/archives.html#Butterworth

- http://www.mitre.org/work/cybersecurity/blog/cyber_tools_butterworth.html

- http://support.dell.com/

Credit

Thanks to Corey Kallenberg, John Butterworth, and Xeno Kovah of the MITRE Corporation for reporting this vulnerability. Thanks also to Rick Martinez from Dell.This document was written by Adam Rauf.

Other Information

- CVE IDs: CVE-2013-3582

- Date Public: 15 Aug 2013

- Date First Published: 15 Aug 2013

- Date Last Updated: 22 Aug 2013

- Document Revision: 54

- wong chee tat :)

Labels:

2013,

anti virus,

aug,

bios,

computer network,

computer networking,

computer virus,

lappy,

laptop,

sept,

Vulnerability

Friday, September 27, 2013

Thursday, September 26, 2013

Scheduled Maintenance - POSB

Scheduled Maintenance - POSB

- wong chee tat :)

| Service | Scheduled Maintenance Date | Expected Downtime | Remarks |

| iBanking | 24 Sep 2013 | 0400hrs to 0500hrs | System Maintenance

|

| 28 Sep 2013 | 1000hrs to 2200hrs | System Maintenance

| |

| 05 Oct 2013 | 1000hrs to 2359hrs | System Maintenance

| |

| 06 Oct 2013 | 0000hrs to 2000hrs | System Maintenance

| |

| 06 Oct 2013 | 0200hrs to 0245hrs | System Maintenance

| |

| 13 Oct 2013 | 0200hrs to 0230hrs | System Maintenance

| |

| 20 Oct 2013 | 0200hrs to 0230hrs | System Maintenance

| |

| mBanking | - | - | - |

| iB Application | - | - | - |

| iB - Trading Services | 28 Sep 2013 | 1000hrs to 2200hrs | System Maintenance |

| 05 Oct 2013 | 1000hrs to 2359hrs | System Maintenance | |

| 06 Oct 2013 | 0000hrs to 2000hrs | System Maintenance | |

| D2Pay | 06 Oct 2013 | 0300hrs to 0600hrs | System Maintenance |

| Phone Banking | - | - | - |

| NETS | - | - | - |

| Passbook Update | - | - | - |

| Automated Teller Machine (ATM) | - | - | - |

| Cash Deposit Machine | - | - | - |

| Coin Deposit Machine | - | - | - |

| Cheque Deposit Machine | - | - | - |

| POSB Print | - | - | - |

| AXS D-Pay | - | - | - |

| Token Registration | - | - | - |

| e-Commerce on 3D Secure Websites | - | - | - |

- wong chee tat :)

Labels:

2013,

DBS,

DBS Bank Ltd,

maintenance,

oct,

posb,

sept,

System Updates,

Update,

Updates

Wednesday, September 25, 2013

Experts say Pakistan quake island unlikely to last

Experts say Pakistan quake island unlikely to last

POSTED: 25 Sep 2013 9:32 PM

A small island created in the Arabian Sea by the huge earthquake that hit southwest Pakistan has fascinated locals but experts say it is unlikely to last long.

GWADAR: A small island of mud and rock created by the huge earthquake that hit southwest Pakistan has fascinated locals but experts -- who found methane gas rising from it -- say it is unlikely to last long.

The 7.7-magnitude quake struck on Tuesday in Baluchistan's remote Awaran district, killing more than 270 people and affecting hundreds of thousands.

Off the coastline near the port of Gwadar, some 400 kilometres (250 miles) from the epicentre, locals were astonished to see the dark grey mass of rock and mud that had emerged from the waves in the Arabian Sea.

"It is not a small thing, but a huge thing which has emerged from under the water," Gwadar resident Muhammad Rustam told AFP.

"It looked very, very strange to me and also a bit scary because suddenly a huge thing has emerged from the water."

Enterprising boat owners were doing a brisk trade ferrying curious sightseers to the island -- dubbed "Earthquake Mountain" by locals.

Mohammad Danish, a marine biologist from Pakistan's National Institute of Oceanography, said a team of experts had visited the island and found methane gas rising.

"Our team found bubbles rising from the surface of the island which caught fire when a match was lit and we forbade our team to start any flame. It is methane gas," Danish said on GEO television news.

The island is about 60 to 70 feet (18 to 21 metres) high, up to 300 feet wide and up to 120 feet long, he said. It sits about 650 feet from the coast.

The surface was a solid but muddy mix of stones, sand and water with visible cracks, said an AFP cameraman who visited the island. Dead fish and sea plants lay on the surface.

Gary Gibson, a seismologist with Australia's University of Melbourne, said the new island was likely to be a "mud volcano", created by methane gas forcing material upwards during the violent shaking of the earthquake.

"It's happened before in that area but it's certainly an unusual event, very rare," Gibson told AFP, adding that it was "very curious" to see such activity some 400 kilometres from the quake's epicentre.

The so-called island is not a fixed structure but a body of mud that will be broken down by wave activity and dispersed over time, the scientist said.

A similar event happened in the same area in 1945 when an 8.1-magnitude earthquake at Makran triggered the formation of mud volcanoes off Gwadar.

Professor Shamim Ahmed Shaikh, chairman of the department of geology at Karachi University, said the island, which has not been officially named, would disperse within a couple of months.

He said it happens along the Makran coast because of the complex relationship between tectonic plates in the area. Pakistan sits close to the junction of three plates -- the Indian, Arabian and Eurasian.

"About a year back an island of almost similar size had surfaced at a similar distance from the coast in the Makran region. This would disperse in a week to a couple of months," Shaikh told AFP.

Gibson said the temporary island was very different from the permanent uplift seen during major "subduction zone" earthquakes, where plate collisions force the Earth's crust suddenly and sometimes dramatically upwards.

For example, in the massive 9.5-magnitude earthquake in Chile in 1960 -- known as the world's largest ever -- whole fishing villages were thrust "several metres" upwards and wharves suddenly located hundreds of metres inland, Gibson said.

Such uplift events are relatively common in the Pacific's so-called "Ring of Fire", a hotbed of seismic and volcanic activity at the junction of several tectonic plates.

A thundering 8.0-magnitude quake in the Solomon Islands in 2007 thrust Ranogga Island upwards by three metres, exposing submerged reefs once popular with divers and killing the vibrant corals, while expanding the shoreline outwards by several metres in the process.

During the massive 9.2-magnitude earthquake off Sumatra which triggered a devastating tsunami across the Indian Ocean in 2004, several islands were pushed upwards while others subsided into the ocean.

The Aceh coast dropped permanently by one metre while Simeulue Island was lifted by as much as 1.5 metres, exposing the surrounding reef, which became the island's new fringe.

- AFP/ec

- wong chee tat :)

POSTED: 25 Sep 2013 9:32 PM

A small island created in the Arabian Sea by the huge earthquake that hit southwest Pakistan has fascinated locals but experts say it is unlikely to last long.

GWADAR: A small island of mud and rock created by the huge earthquake that hit southwest Pakistan has fascinated locals but experts -- who found methane gas rising from it -- say it is unlikely to last long.

The 7.7-magnitude quake struck on Tuesday in Baluchistan's remote Awaran district, killing more than 270 people and affecting hundreds of thousands.

Off the coastline near the port of Gwadar, some 400 kilometres (250 miles) from the epicentre, locals were astonished to see the dark grey mass of rock and mud that had emerged from the waves in the Arabian Sea.

"It is not a small thing, but a huge thing which has emerged from under the water," Gwadar resident Muhammad Rustam told AFP.

"It looked very, very strange to me and also a bit scary because suddenly a huge thing has emerged from the water."

Enterprising boat owners were doing a brisk trade ferrying curious sightseers to the island -- dubbed "Earthquake Mountain" by locals.

Mohammad Danish, a marine biologist from Pakistan's National Institute of Oceanography, said a team of experts had visited the island and found methane gas rising.

"Our team found bubbles rising from the surface of the island which caught fire when a match was lit and we forbade our team to start any flame. It is methane gas," Danish said on GEO television news.

The island is about 60 to 70 feet (18 to 21 metres) high, up to 300 feet wide and up to 120 feet long, he said. It sits about 650 feet from the coast.

The surface was a solid but muddy mix of stones, sand and water with visible cracks, said an AFP cameraman who visited the island. Dead fish and sea plants lay on the surface.

Gary Gibson, a seismologist with Australia's University of Melbourne, said the new island was likely to be a "mud volcano", created by methane gas forcing material upwards during the violent shaking of the earthquake.

"It's happened before in that area but it's certainly an unusual event, very rare," Gibson told AFP, adding that it was "very curious" to see such activity some 400 kilometres from the quake's epicentre.

The so-called island is not a fixed structure but a body of mud that will be broken down by wave activity and dispersed over time, the scientist said.

A similar event happened in the same area in 1945 when an 8.1-magnitude earthquake at Makran triggered the formation of mud volcanoes off Gwadar.

Professor Shamim Ahmed Shaikh, chairman of the department of geology at Karachi University, said the island, which has not been officially named, would disperse within a couple of months.

He said it happens along the Makran coast because of the complex relationship between tectonic plates in the area. Pakistan sits close to the junction of three plates -- the Indian, Arabian and Eurasian.

"About a year back an island of almost similar size had surfaced at a similar distance from the coast in the Makran region. This would disperse in a week to a couple of months," Shaikh told AFP.

Gibson said the temporary island was very different from the permanent uplift seen during major "subduction zone" earthquakes, where plate collisions force the Earth's crust suddenly and sometimes dramatically upwards.

For example, in the massive 9.5-magnitude earthquake in Chile in 1960 -- known as the world's largest ever -- whole fishing villages were thrust "several metres" upwards and wharves suddenly located hundreds of metres inland, Gibson said.

Such uplift events are relatively common in the Pacific's so-called "Ring of Fire", a hotbed of seismic and volcanic activity at the junction of several tectonic plates.

A thundering 8.0-magnitude quake in the Solomon Islands in 2007 thrust Ranogga Island upwards by three metres, exposing submerged reefs once popular with divers and killing the vibrant corals, while expanding the shoreline outwards by several metres in the process.

During the massive 9.2-magnitude earthquake off Sumatra which triggered a devastating tsunami across the Indian Ocean in 2004, several islands were pushed upwards while others subsided into the ocean.

The Aceh coast dropped permanently by one metre while Simeulue Island was lifted by as much as 1.5 metres, exposing the surrounding reef, which became the island's new fringe.

- AFP/ec

- wong chee tat :)

No room to move under debt cap after Oct 17: US Treasury

No room to move under debt cap after Oct 17: US Treasury

POSTED: 25 Sep 2013 10:35 PM

The Treasury Secretary Jacob Lew warned Wednesday that the government will have no more flexibility after October 17 to operate under the US debt cap.

WASHINGTON: Treasury Secretary Jacob Lew warned Wednesday the US government will have no more flexibility to juggle spending and meet its obligations after October 17, under a statutory debt cap.

Lew told Congress that, after months of maneuvers to meet government commitments without added borrowing, those "extraordinary measures" will be exhausted by that date.

That will leave the Treasury with only US$30 billion in cash to meet ever-mounting demands that can only be met by borrowing more money.

"This amount would be far short of net expenditures on certain days, which can be as high as US$60 billion," Lew said in a letter addressed to John Boehner, speaker of the House of Representatives.

"If we have insufficient cash on hand, it would be impossible for the United States of America to meet all of its obligations for the first time in our history."

Lew urged the House to increase the borrowing ceiling, which has been locked at US$16.7 trillion since May.

"Extending borrowing authority does not increase government spending; it simply allows the Treasury to pay for expenditures Congress has already approved," he wrote.

"As such, I respectfully urge Congress to act immediately to meet its responsibility by extending the nation's borrowing authority."

The letter came as Republicans in Congress House battle with the White House over the government's budget for fiscal 2014, which begins on October 1.

Republican refusal to back any new spending bill that provides funding for President Barack Obama's signature health care reforms could lead to a government shutdown.

In a similar battle in July-August 2011, the issue of raising the debt ceiling was wrapped into the budget fight, and many worry the same could happen again in a fresh bout of brinkmanship that could rock markets.

So far the two issues have remained separate, but in anticipation of another possible debt ceiling crisis, the House has already passed legislation setting priorities for spending in case the Treasury has to miss some payments.

In his letter on Wednesday, Lew called that legislation "ill-advised", saying the government "should never have to choose" between paying salaries, retirement or health care benefits, or other obligations.

"There is no way of knowing the damage any prioritisation plan would have on our economy and financial markets," he warned.

Lew reminded lawmakers that the 2011 impasse over the debt ceiling and the budget "caused significant harm to the economy".

That fight was resolved just hours before the country could have defaulted on its debt, but nevertheless led to a historic downgrade of the US credit rating, the first time ever it lost its AAA status with Standard & Poor's.

"If Congress were to repeat that brinkmanship in 2013, it could inflict even greater harm on the economy," Lew said in his letter.

"And if the government should ultimately become unable to pay all of its bills, the results could be catastrophic."

"Extending borrowing authority does not increase government spending; it simply allows the Treasury to pay for expenditures Congress has already approved," he wrote.

"As such, I respectfully urge Congress to act immediately to meet its responsibility by extending the nation's borrowing authority."

- AFP/ec

- wong chee tat :)

POSTED: 25 Sep 2013 10:35 PM

The Treasury Secretary Jacob Lew warned Wednesday that the government will have no more flexibility after October 17 to operate under the US debt cap.

WASHINGTON: Treasury Secretary Jacob Lew warned Wednesday the US government will have no more flexibility to juggle spending and meet its obligations after October 17, under a statutory debt cap.

Lew told Congress that, after months of maneuvers to meet government commitments without added borrowing, those "extraordinary measures" will be exhausted by that date.

That will leave the Treasury with only US$30 billion in cash to meet ever-mounting demands that can only be met by borrowing more money.

"This amount would be far short of net expenditures on certain days, which can be as high as US$60 billion," Lew said in a letter addressed to John Boehner, speaker of the House of Representatives.

"If we have insufficient cash on hand, it would be impossible for the United States of America to meet all of its obligations for the first time in our history."

Lew urged the House to increase the borrowing ceiling, which has been locked at US$16.7 trillion since May.

"Extending borrowing authority does not increase government spending; it simply allows the Treasury to pay for expenditures Congress has already approved," he wrote.

"As such, I respectfully urge Congress to act immediately to meet its responsibility by extending the nation's borrowing authority."

The letter came as Republicans in Congress House battle with the White House over the government's budget for fiscal 2014, which begins on October 1.

Republican refusal to back any new spending bill that provides funding for President Barack Obama's signature health care reforms could lead to a government shutdown.

In a similar battle in July-August 2011, the issue of raising the debt ceiling was wrapped into the budget fight, and many worry the same could happen again in a fresh bout of brinkmanship that could rock markets.

So far the two issues have remained separate, but in anticipation of another possible debt ceiling crisis, the House has already passed legislation setting priorities for spending in case the Treasury has to miss some payments.

In his letter on Wednesday, Lew called that legislation "ill-advised", saying the government "should never have to choose" between paying salaries, retirement or health care benefits, or other obligations.

"There is no way of knowing the damage any prioritisation plan would have on our economy and financial markets," he warned.

Lew reminded lawmakers that the 2011 impasse over the debt ceiling and the budget "caused significant harm to the economy".

That fight was resolved just hours before the country could have defaulted on its debt, but nevertheless led to a historic downgrade of the US credit rating, the first time ever it lost its AAA status with Standard & Poor's.

"If Congress were to repeat that brinkmanship in 2013, it could inflict even greater harm on the economy," Lew said in his letter.

"And if the government should ultimately become unable to pay all of its bills, the results could be catastrophic."

"Extending borrowing authority does not increase government spending; it simply allows the Treasury to pay for expenditures Congress has already approved," he wrote.

"As such, I respectfully urge Congress to act immediately to meet its responsibility by extending the nation's borrowing authority."

- AFP/ec

- wong chee tat :)

NTUC Fairprice dividend 2013

NTUC Fairprice declared special dividend of 2.5% and special rebate of 0.5%.

- wong chee tat :)

- wong chee tat :)

Tuesday, September 24, 2013

Monday, September 23, 2013

Sunday, September 22, 2013

Still Sick

Why am I still coughing and feeling sickish? Lots of things waiting for me to do. =(

- wong chee tat :)

- wong chee tat :)

Scheduled Maintenance - POSB

Scheduled Maintenance - POSB

- wong chee tat :)

| Service | Scheduled Maintenance Date | Expected Downtime | Remarks |

| iBanking | 21 Sep 2013 | 0945hrs to 0950hrs | System Maintenance

|

| 21 Sep 2013 | 0945hrs to 2359hrs | System Maintenance

| |

| 21 Sep 2013 | 1210hrs to 1215hrs | System Maintenance

| |

| 22 Sep 2013 | 0000hrs to 1540hrs | System Maintenance

| |

| 22 Sep 2013 | 0200hrs to 0230hrs | System Maintenance

| |

| 22 Sep 2013 | 1045hrs to 1050hrs | System Maintenance

| |

| 22 Sep 2013 | 1335hrs to 1340hrs | System Maintenance

| |

| 24 Sep 2013 | 0400hrs to 0500hrs | System Maintenance

| |

| 28 Sep 2013 | 1000hrs to 2200hrs | System Maintenance

| |

| 05 Oct 2013 | 1000hrs to 2359hrs | System Maintenance

| |

| 06 Oct 2013 | 0000hrs to 2000hrs | System Maintenance

| |

| 13 Oct 2013 | 0200hrs to 0230hrs | System Maintenance

| |

| 20 Oct 2013 | 0200hrs to 0230hrs | System Maintenance

| |

| mBanking | - | - | - |

| iB Application | - | - | - |

| iB - Trading Services | 21 Sep 2013 | 1000hrs to 2359hrs | System Maintenance |

| 22 Sep 2013 | 0000hrs to 1100hrs | System Maintenance | |

| 28 Sep 2013 | 1000hrs to 2200hrs | System Maintenance | |

| 05 Oct 2013 | 1000hrs to 2359hrs | System Maintenance | |

| 06 Oct 2013 | 0000hrs to 2000hrs | System Maintenance | |

| D2Pay | - | - | - |

| Phone Banking | - | - | - |

| NETS | - | - | - |

| Passbook Update | - | - | - |

| Automated Teller Machine (ATM) | - | - | - |

| Cash Deposit Machine | - | - | - |

| Coin Deposit Machine | - | - | - |

| Cheque Deposit Machine | - | - | - |

| POSB Print | - | - | - |

| AXS D-Pay | - | - | - |

| Token Registration | - | - | - |

| e-Commerce on 3D Secure Websites | - | - | - |

- wong chee tat :)

Labels:

2013,

DBS,

DBS Bank Ltd,

maintenance,

posb,

sept,

System Updates,

Update,

Updates

Saturday, September 21, 2013

Friday, September 20, 2013

Thursday, September 19, 2013

HDB Issues Fixed Rate Notes

HDB Issues Fixed Rate Notes

Date issued : 19 Sep 2013

The Housing and Development Board ("HDB") has issued S$1.45 billion, 5-year Fixed Rate Notes (the “Notes”) under its S$22 billion Multicurrency Medium Term Note ("MTN") Programme.

2 The Notes have a coupon of 2.365% per annum payable semi-annually in arrear. The Notes were issued on 19 September 2013 and will mature on 19 September 2018.

3 The Notes are in denominations of S$250,000 and were offered by way of placement to investors who fall within Sections 274 and/or 275 of the Securities and Futures Act, Chapter 289 of Singapore. Approval in principle for the listing of the Notes on the Singapore Exchange Securities Trading Limited (SGX-ST) has been obtained. Admission of the Notes to the Official List of the SGX-ST is not to be taken as an indication of the merits of HDB, its subsidiaries or the Notes. The Notes are cleared through The Central Depository (Pte) Limited.

4 The Joint Lead Managers are Australia and New Zealand Banking Group Limited, BNP Paribas, Singapore Branch, CIMB Bank Berhad, DBS Bank Ltd., Deutsche Bank AG, Singapore Branch, DMG & Partners Securities Pte Ltd, The Hongkong and Shanghai Banking Corporation Limited, Oversea-Chinese Banking Corporation Limited, Standard Chartered Bank and United Overseas Bank Limited.

5 Under HDB's MTN programme, HDB may from time to time, issue bonds (or notes) to finance its development programmes and working capital requirements as well as to refinance the existing borrowings.

6 HDB was set up as a statutory board on 1 February 1960. HDB houses more than 80% of Singapore's resident population and enables more than nine out of ten of them to be homeowners. This has made Singapore one of the highest home ownership nations in the world. The provision of quality housing and related services, and the renewal of the older HDB estates, will remain the focus for HDB.

NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OR TO U.S. PERSONS

This announcement is not an offer for sale of securities in the United States. The Notes have not been and will not be registered under the U.S. Securities Act of 1933 (as amended), and may not be offered or sold in the United States or to U.S. persons absent registration under, or an applicable exemption from, the registration requirements of the U.S. securities laws. No public offering of securities is being made in the United States or in any other jurisdiction where such an offering is restricted or prohibited.

- wong chee tat :)

Date issued : 19 Sep 2013

The Housing and Development Board ("HDB") has issued S$1.45 billion, 5-year Fixed Rate Notes (the “Notes”) under its S$22 billion Multicurrency Medium Term Note ("MTN") Programme.

2 The Notes have a coupon of 2.365% per annum payable semi-annually in arrear. The Notes were issued on 19 September 2013 and will mature on 19 September 2018.

3 The Notes are in denominations of S$250,000 and were offered by way of placement to investors who fall within Sections 274 and/or 275 of the Securities and Futures Act, Chapter 289 of Singapore. Approval in principle for the listing of the Notes on the Singapore Exchange Securities Trading Limited (SGX-ST) has been obtained. Admission of the Notes to the Official List of the SGX-ST is not to be taken as an indication of the merits of HDB, its subsidiaries or the Notes. The Notes are cleared through The Central Depository (Pte) Limited.

4 The Joint Lead Managers are Australia and New Zealand Banking Group Limited, BNP Paribas, Singapore Branch, CIMB Bank Berhad, DBS Bank Ltd., Deutsche Bank AG, Singapore Branch, DMG & Partners Securities Pte Ltd, The Hongkong and Shanghai Banking Corporation Limited, Oversea-Chinese Banking Corporation Limited, Standard Chartered Bank and United Overseas Bank Limited.

5 Under HDB's MTN programme, HDB may from time to time, issue bonds (or notes) to finance its development programmes and working capital requirements as well as to refinance the existing borrowings.

6 HDB was set up as a statutory board on 1 February 1960. HDB houses more than 80% of Singapore's resident population and enables more than nine out of ten of them to be homeowners. This has made Singapore one of the highest home ownership nations in the world. The provision of quality housing and related services, and the renewal of the older HDB estates, will remain the focus for HDB.

NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OR TO U.S. PERSONS

This announcement is not an offer for sale of securities in the United States. The Notes have not been and will not be registered under the U.S. Securities Act of 1933 (as amended), and may not be offered or sold in the United States or to U.S. persons absent registration under, or an applicable exemption from, the registration requirements of the U.S. securities laws. No public offering of securities is being made in the United States or in any other jurisdiction where such an offering is restricted or prohibited.

- wong chee tat :)

Wednesday, September 18, 2013

Tuesday, September 17, 2013

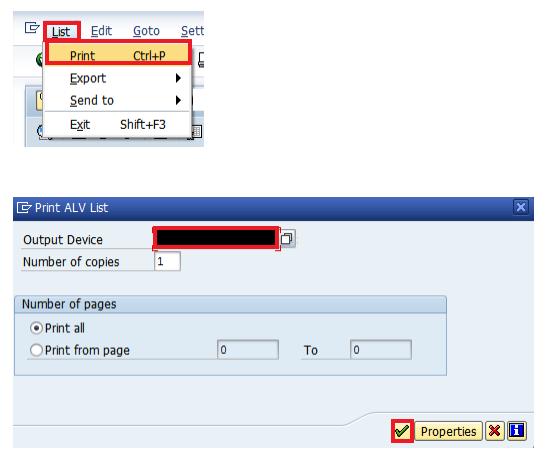

Printing in SAP

To select the printer to print in SAP:

In SAP, go to List then select Print.

You should see a dialog box: Print ALV List. Then, type the name of the printer and select the green check box to print.

The printer should start printing immediately.

- wong chee tat :)

Labels:

2013,

computer network,

computer networking,

mobile network,

network,

print,

printer,

printing,

printout,

Prints,

SAP

Monday, September 16, 2013

Sunday, September 15, 2013

Types of debt securities eligible for listing on SGX

| Fixed & Floating Rate Bonds | Fixed rate bonds pay a fixed coupon rate throughout the life of a bond . Floating rate bonds has a variable coupon rate. Coupon rate adjustments are made periodically. |

| Convertible & Exchangeable Bonds | Convertible bonds give investors an option to convert bonds into shares of the issuer. Exchangeable bonds give investors an option to convert bonds into shares of a company other than the issue. |

| Covered Bonds | Covered bonds are debt securities that are secured by a pool of loans or mortgages. |

| Asset Backed Securities | Asset backed securities are bonds or notes backed by a specified pool of underlying assets. |

| Loan Participation Notes | A type of debt security that permits investors to buy portions of an outstanding loan or a package of loans. |

| Commercial Papers | Unsecured, short term debt instruments issued by large banks and corporations to finance their short term credit needs. |

| Hybrid Capital Securities | A type of security that has both equity and debt features, for example, preference shares. |

| Structured Products | Synthetic investment instruments specially created to meet specific needs that cannot be met from the standardized financial instruments available in the markets. |

Source: SGX

- wong chee tat :)

Labels:

buy,

buyers,

cash,

debt,

investors,

loans,

market,

money,

opportunities,

rich,

Rich Dad,

Rich Dad Poor Dad,

sale,

sell,

sophisticated investors

Saturday, September 14, 2013

Coughing and Coughing

Still not feeling well and need a break.Let me have a quick recovery please.

- wong chee tat :)

- wong chee tat :)

Malware Attack my browsers

Anyone got this funny search link: websearch(dot)the-searcheng(dot)info?

On the first look, it looks like a simple search engine and a web ad. I thought google had changed their search engine.

I got this search link affecting the following browsers: IE, Mozilla Firefox and Google Chrome. As long as you select a new tab, the affected browser will point and redirect to the intended link: websearch(dot)the-searcheng(dot)info.

Did some searches to find out the the behavior of the search and learned that it is some kind of malware and infected my computer.

Detection and Removal:

Perform a anti-malware scan and removed the infected stuff but it still stays. I even uninstalled and reinstalled firefox and it stayed! So what is next?

.

Reset to the default state helps.

For IE, go to Internet Options and select the Reset button and let it reset. Remember to check if the link appears in the home page (Look under Internet Options --> General tab) and change it.

For Mozilla Firefox, go to Firefox --> Help --> Troubleshooting Information and look for Reset Firefox button. Click on the reset firefox button and reset it.For my case, it takes a couple of minutes and after that the link does not show up any more when I select a new tab.

For Google chrome, look for a button with 3 horizontal bars on the top right side of the browser and click it. Select Settings and look fo Reset browser settings. Click on Reset browser settings.

I didn't install Opera nor Safari and I cannot comment if the method work for Opera and Safari.

- wong chee tat :)

On the first look, it looks like a simple search engine and a web ad. I thought google had changed their search engine.

I got this search link affecting the following browsers: IE, Mozilla Firefox and Google Chrome. As long as you select a new tab, the affected browser will point and redirect to the intended link: websearch(dot)the-searcheng(dot)info.

Did some searches to find out the the behavior of the search and learned that it is some kind of malware and infected my computer.

Detection and Removal:

Perform a anti-malware scan and removed the infected stuff but it still stays. I even uninstalled and reinstalled firefox and it stayed! So what is next?

.

Reset to the default state helps.

For IE, go to Internet Options and select the Reset button and let it reset. Remember to check if the link appears in the home page (Look under Internet Options --> General tab) and change it.

For Mozilla Firefox, go to Firefox --> Help --> Troubleshooting Information and look for Reset Firefox button. Click on the reset firefox button and reset it.For my case, it takes a couple of minutes and after that the link does not show up any more when I select a new tab.

For Google chrome, look for a button with 3 horizontal bars on the top right side of the browser and click it. Select Settings and look fo Reset browser settings. Click on Reset browser settings.

I didn't install Opera nor Safari and I cannot comment if the method work for Opera and Safari.

- wong chee tat :)

Labels:

2013,

anti virus,

computer network,

computer networking,

computer virus,

malware,

sept,

virus

That 2 weeks...

Mentioned in my last posts before, my dad passed away suddenly. There were a lot of changes needed to be made. Most of the nights, I could not sleep well.

Asking around friends and colleagues on such stuff and checking with various places and companies like : cpf, iras, utility companies on such matters, transferring his name to mine and various whatever paperwork needed to be done and really running around like a mad dog. This is no fun and very tiring

- wong chee tat :)

Asking around friends and colleagues on such stuff and checking with various places and companies like : cpf, iras, utility companies on such matters, transferring his name to mine and various whatever paperwork needed to be done and really running around like a mad dog. This is no fun and very tiring

- wong chee tat :)

Friday, September 13, 2013

Scheduled Maintenance - POSB

Scheduled Maintenance

- wong chee rar :)

| Service | Scheduled Maintenance Date | Expected Downtime | Remarks |

| iBanking | 15 Sep 2013 | 0000hrs to 0400hrs | System Maintenance

|

| 21 Sep 2013 | 0945hrs to 0950hrs | System Maintenance

| |

| 21 Sep 2013 | 0945hrs to 2359hrs | System Maintenance

| |

| 21 Sep 2013 | 1000hrs to 2359hrs | System Maintenance

| |

| 21 Sep 2013 | 1412hrs to 1417hrs | System Maintenance

| |

| 22 Sep 2013 | 0000hrs to 1100hrs | System Maintenance

| |

| 22 Sep 2013 | 0000hrs to 0015hrs | System Maintenance

| |

| 22 Sep 2013 | 0200hrs to 0230hrs | System Maintenance

| |

| 22 Sep 2013 | 1045hrs to 1050hrs | System Maintenance

| |

| 22 Sep 2013 | 1045hrs to 1540hrs | System Maintenance

| |

| 22 Sep 2013 | 1335hrs to 1340hrs | System Maintenance

| |

| 24 Sep 2013 | 0400hrs to 0500hrs | System Maintenance

| |

| 13 Oct 2013 | 0200hrs to 0230hrs | System Maintenance

| |

| 20 Oct 2013 | 0200hrs to 0230hrs | System Maintenance

| |

| mBanking | - | - | - |

| iB Application | - | - | - |

| iB - Trading Services | 21 Sep 2013 | 1000hrs to 2359hrs | System Maintenance |

| 22 Sep 2013 | 0000hrs to 1100hrs | System Maintenance | |

| D2Pay | - | - | - |

| Phone Banking | - | - | - |

| NETS | - | - | - |

| Passbook Update | - | - | - |

| Automated Teller Machine (ATM) | - | - | - |

| Cash Deposit Machine | - | - | - |

| Coin Deposit Machine | - | - | - |

| Cheque Deposit Machine | - | - | - |

| POSB Print | - | - | - |

| AXS D-Pay | - | - | - |

| Token Registration | - | - | - |

| e-Commerce on 3D Secure Websites | - | - | - |

- wong chee rar :)

Labels:

2013,

DBS,

DBS Bank Ltd,

maintenance,

posb,

sept,

System Updates,

Update,

Updates

Thursday, September 12, 2013

Pentair opens new regional headquarters in Singapore

Pentair opens new regional headquarters in Singapore

POSTED: 12 Sep 2013 8:53 PM

Manufacturing firm Pentair has opened its new Southeast Asia regional headquarters in Singapore.

SINGAPORE: Manufacturing firm Pentair has opened its new Southeast Asia regional headquarters in Singapore.

The new office will consolidate its operations from seven locations across Singapore to a single 16,000-square-feet space.

More than 100 employees will move into the office in Tuas, which already houses some 100 employees, most of whom are engaged in engineering support.

In a statement released on Thursday, Pentair said the new office will support more than 500 employees in countries across Southeast Asia, and factories in Malaysia and Indonesia.

"Singapore is the logical location for any industrial organisation with serious ambitions in Southeast Asia and beyond. It offers convenient access to neighbouring countries and excellent business links with regional economic powerhouses such as China," said Lawrence Thong, Pentair's vice president and managing director for Southeast Asia.

Some of the global business units at Pentair's regional headquarters in Singapore include water and environmental services, valves and controls, and thermal management

With pro forma global revenues of more than US$8 billion, Pentair was formed last year through the merger of Pentair Inc and the Flow Control business of NYSE-listed Tyco International Ltd.

- CNA/ms

- wong chee tat :)

POSTED: 12 Sep 2013 8:53 PM

Manufacturing firm Pentair has opened its new Southeast Asia regional headquarters in Singapore.

SINGAPORE: Manufacturing firm Pentair has opened its new Southeast Asia regional headquarters in Singapore.

The new office will consolidate its operations from seven locations across Singapore to a single 16,000-square-feet space.

More than 100 employees will move into the office in Tuas, which already houses some 100 employees, most of whom are engaged in engineering support.

In a statement released on Thursday, Pentair said the new office will support more than 500 employees in countries across Southeast Asia, and factories in Malaysia and Indonesia.

"Singapore is the logical location for any industrial organisation with serious ambitions in Southeast Asia and beyond. It offers convenient access to neighbouring countries and excellent business links with regional economic powerhouses such as China," said Lawrence Thong, Pentair's vice president and managing director for Southeast Asia.

Some of the global business units at Pentair's regional headquarters in Singapore include water and environmental services, valves and controls, and thermal management

With pro forma global revenues of more than US$8 billion, Pentair was formed last year through the merger of Pentair Inc and the Flow Control business of NYSE-listed Tyco International Ltd.

- CNA/ms

- wong chee tat :)

Labels:

2013,

asia,

buy,

buyers,

employability,

employment,

job seekers,

jobs,

market,

opportunities,

Pentair,

sell,

singapore

Mixed reactions over changes to COE

Mixed reactions over changes to COE

By Dylan Loh

POSTED: 09 Sep 2013 8:48 PM

The changes to the Certificate of Entitlement system drew mixed reactions, with several car dealers saying it does not solve the problem of tight supply.

SINGAPORE: The changes to the Certificate of Entitlement system drew mixed reactions, with several car dealers saying it does not solve the problem of tight supply.

While premium models will be shifted to the big cars category, dealers said a limited quota of certificates will likely cause prices to remain high.

Prospective car-buyers Channel NewsAsia spoke to said they will continue to observe the market before making any decisions.

One of them, Vijay Sabapathy, intends to monitor car prices for three months after Certificate of Entitlement (COE) changes kick in from February 2014.

The 33-year-old prospective buyer is looking for a mass market ride, but doubts prices will drop even with authorities taking premium models out of the small cars COE category using vehicle-horsepower and engine capacity as factors.

He said: "If you move one category of buyers out, it will just mean that the floodgates will be opened for everyone else who's waiting to buy a car to jump in."

Others are more optimistic. Another prospective car buyer, Tseng Hsien Cho, said: "Hopefully this measure will allow the mass public from the middle sector, from the middle-income group, to have a chance to own a car."

Once the changes are in place, car dealers said mass market Japanese models, which have been on a popularity decline in recent times, may make a comeback. Dealers of performance vehicles meanwhile, expect a "crowding effect" in the COE Category B section for big cars.

Henry Heng, manager of Prime Cars, said: "There is very heavy traffic in the Cat B already. I think (the cost will) depend on how much COE they can give for Cat B."

Future COE quotas then, will likely affect how high prices go for premium models.

Raymond Tang, honorary secretary of the Singapore Vehicle Traders Association, said: "When there is more COE released, definitely the COE price will be more stable."

Associate Professor Lee Der-Horng, a transport researcher with the National University of Singapore, said: "Perhaps we should consider a constant COE supply, which means maybe on an annual basis, we just have the 65,000 or 70,000 -- depending on the actual evaluation and testing."

Observers expect cars which will eventually be shifted under the COE Category B section to enjoy healthy demand before changes take effect. Some even think big car COE prices may rise above the S$100,000 mark, with more vehicles expected to be moved into the category.

Dr Janil Puthucheary, a member of the Transport Government Parliamentary Committee, felt that the latest changes to the COE system are fair, and likely the best that can be currently achieved.

Dr Janil said the COE system maintains the idea that cars are a luxury, rather than a necessity. However, he said the tweaks still make cars available to those who view them as a necessity.

He also explained why some suggestions were dropped, such as a surcharge for those with more than one car.

Dr Janil said: "Implementing a surcharge for multiple car ownership will be very difficult to police. There are many ways around it. But also, it affects a very small segment of the total car population.

"It's not going to have a desired effect of making mass market car more accessible to the people whom Cat A was meant for. That's the fundamental thing we're trying to achieve here."

- CNA/ac

- wong chee tat :)

By Dylan Loh

POSTED: 09 Sep 2013 8:48 PM

The changes to the Certificate of Entitlement system drew mixed reactions, with several car dealers saying it does not solve the problem of tight supply.

SINGAPORE: The changes to the Certificate of Entitlement system drew mixed reactions, with several car dealers saying it does not solve the problem of tight supply.

While premium models will be shifted to the big cars category, dealers said a limited quota of certificates will likely cause prices to remain high.

Prospective car-buyers Channel NewsAsia spoke to said they will continue to observe the market before making any decisions.

One of them, Vijay Sabapathy, intends to monitor car prices for three months after Certificate of Entitlement (COE) changes kick in from February 2014.

The 33-year-old prospective buyer is looking for a mass market ride, but doubts prices will drop even with authorities taking premium models out of the small cars COE category using vehicle-horsepower and engine capacity as factors.

He said: "If you move one category of buyers out, it will just mean that the floodgates will be opened for everyone else who's waiting to buy a car to jump in."

Others are more optimistic. Another prospective car buyer, Tseng Hsien Cho, said: "Hopefully this measure will allow the mass public from the middle sector, from the middle-income group, to have a chance to own a car."

Once the changes are in place, car dealers said mass market Japanese models, which have been on a popularity decline in recent times, may make a comeback. Dealers of performance vehicles meanwhile, expect a "crowding effect" in the COE Category B section for big cars.

Henry Heng, manager of Prime Cars, said: "There is very heavy traffic in the Cat B already. I think (the cost will) depend on how much COE they can give for Cat B."

Future COE quotas then, will likely affect how high prices go for premium models.

Raymond Tang, honorary secretary of the Singapore Vehicle Traders Association, said: "When there is more COE released, definitely the COE price will be more stable."

Associate Professor Lee Der-Horng, a transport researcher with the National University of Singapore, said: "Perhaps we should consider a constant COE supply, which means maybe on an annual basis, we just have the 65,000 or 70,000 -- depending on the actual evaluation and testing."

Observers expect cars which will eventually be shifted under the COE Category B section to enjoy healthy demand before changes take effect. Some even think big car COE prices may rise above the S$100,000 mark, with more vehicles expected to be moved into the category.

Dr Janil Puthucheary, a member of the Transport Government Parliamentary Committee, felt that the latest changes to the COE system are fair, and likely the best that can be currently achieved.

Dr Janil said the COE system maintains the idea that cars are a luxury, rather than a necessity. However, he said the tweaks still make cars available to those who view them as a necessity.

He also explained why some suggestions were dropped, such as a surcharge for those with more than one car.

Dr Janil said: "Implementing a surcharge for multiple car ownership will be very difficult to police. There are many ways around it. But also, it affects a very small segment of the total car population.

"It's not going to have a desired effect of making mass market car more accessible to the people whom Cat A was meant for. That's the fundamental thing we're trying to achieve here."

- CNA/ac

- wong chee tat :)

Wednesday, September 11, 2013

Mount Sophia residential site attracts 9 bids

Mount Sophia residential site attracts 9 bids

POSTED: 10 Sep 2013 7:33 PM

A residential site at Mount Sophia attracted nine bids at the close of its tender on Tuesday, according to the Urban Redevelopment Authority (URA), with the highest bid submitted at S$442.28 million.

SINGAPORE: A residential site at Mount Sophia attracted nine bids at the close of its tender on Tuesday, according to the Urban Redevelopment Authority (URA).

The highest bid was submitted by a consortium comprising Hoi Hup Realty, Sunway Developments and S C Wong Holdings at S$442.28 million.

This works out to a land price of S$1,157 per square foot per plot ratio (psf ppr).

The top bid is only 0.1 per cent higher than the second highest bid, placed by Fantasia Investment (Singapore) and Singhome (Mount Sophia) at S$442 million.

EL Development submitted the lowest bid at S$284.8 million.

The tender for the 99-year leasehold site was launched on June 28.

The project is located near Dhoby Ghaut MRT Station, the Orchard Road shopping belt and the cultural areas of Little India.

It has a site area of 23,770.5 square metres and maximum permissible gross floor area (GFA) of 35,528 square metres.

In a statement, Colliers International's director of research & advisory Chia Siew Chuin said: "The land parcel is unique, as the government rarely releases for sale, residential sites located in the prime district 9 area."

The site is made up of the former Methodist Girls' School and Trinity Theological College.

Ms Chia adds that "the unique history of the location might also strike a sentimental chord with homebuyers".

At a land price of S$1,157 psf ppr, analysts estimate the break-even cost for the new project to range from S$1,650 per sq ft to S$1,750 per sq ft.

This means when units at the new project are ready for launch, the selling price could start from S$1,900 per sq ft.

- CNA/gn

- wong chee tat :)

POSTED: 10 Sep 2013 7:33 PM

A residential site at Mount Sophia attracted nine bids at the close of its tender on Tuesday, according to the Urban Redevelopment Authority (URA), with the highest bid submitted at S$442.28 million.

SINGAPORE: A residential site at Mount Sophia attracted nine bids at the close of its tender on Tuesday, according to the Urban Redevelopment Authority (URA).

The highest bid was submitted by a consortium comprising Hoi Hup Realty, Sunway Developments and S C Wong Holdings at S$442.28 million.

This works out to a land price of S$1,157 per square foot per plot ratio (psf ppr).

The top bid is only 0.1 per cent higher than the second highest bid, placed by Fantasia Investment (Singapore) and Singhome (Mount Sophia) at S$442 million.

EL Development submitted the lowest bid at S$284.8 million.

The tender for the 99-year leasehold site was launched on June 28.

The project is located near Dhoby Ghaut MRT Station, the Orchard Road shopping belt and the cultural areas of Little India.

It has a site area of 23,770.5 square metres and maximum permissible gross floor area (GFA) of 35,528 square metres.

In a statement, Colliers International's director of research & advisory Chia Siew Chuin said: "The land parcel is unique, as the government rarely releases for sale, residential sites located in the prime district 9 area."

The site is made up of the former Methodist Girls' School and Trinity Theological College.

Ms Chia adds that "the unique history of the location might also strike a sentimental chord with homebuyers".

At a land price of S$1,157 psf ppr, analysts estimate the break-even cost for the new project to range from S$1,650 per sq ft to S$1,750 per sq ft.

This means when units at the new project are ready for launch, the selling price could start from S$1,900 per sq ft.

- CNA/gn

- wong chee tat :)

Labels:

2013,

Dhoby Ghaut,

Hoi Hup Realty,

MRT,

orchard,

S C Wong Holdings,

sept,

Sunway Developments

Tuesday, September 10, 2013

Monday, September 9, 2013

Sunday, September 8, 2013

Scheduled Maintenance - POSB

Scheduled Maintenance - POSB

- wong chee tat :)

| Service | Scheduled Maintenance Date | Expected Downtime | Remarks |

| iBanking | 07 Sep 2013 | 1000hrs to 2359hrs | System Maintenance

|

| 07 Sep 2013 | 2200hrs to 2359hrs | System Maintenance

| |

| 08 Sep 2013 | 0000hrs to 1200hrs | System Maintenance

| |

| 08 Sep 2013 | 0410hrs to 0430hrs | System Maintenance

| |

| 08 Sep 2013 | 1000hrs to 1020hrs | System Maintenance

| |

| 08 Sep 2013 | 1240hrs to 1245hrs | System Maintenance

| |

| 08 Sep 2013 | 1240hrs to 1442hrs | System Maintenance

| |

| 08 Sep 2013 | 1412hrs to 1417hrs | System Maintenance

| |

| 15 Sep 2013 | 0000hrs to 0400hrs | System Maintenance

| |

| mBanking | - | - | - |

| iB Application | 07 Sep 2013 | 2200hrs to 2359hrs | System Maintenance |

| 08 Sep 2013 | 0000hrs to 1200hrs | System Maintenance | |

| iB - Trading Services | 07 Sep 2013 | 1000hrs to 2359hrs | System Maintenance |

| 08 Sep 2013 | 0000hrs to 1200hrs | System Maintenance | |

| D2Pay | - | - | - |

| Phone Banking | - | - | - |

| NETS | - | - | - |

| Passbook Update | - | - | - |

| Automated Teller Machine (ATM) | - | - | - |

| Cash Deposit Machine | - | - | - |

| Coin Deposit Machine | - | - | - |

| Cheque Deposit Machine | - | - | - |

| POSB Print | - | - | - |

| AXS D-Pay | - | - | - |

| Token Registration | - | - | - |

| e-Commerce on 3D Secure Websites | - | - | - |

- wong chee tat :)

Labels:

2013,

august,

DBS,

DBS Bank Ltd,

maintenance,

posb,

sept,

System Updates,

Update,

Updates

Saturday, September 7, 2013

COV for HDB resale flats drops to 4-year low

COV for HDB resale flats drops to 4-year low

By Olivia Siong

POSTED: 06 Sep 2013 8:53 PM

The overall Cash-Over-Valuation for HDB resale flats dropped to S$18,000 in August, the lowest level since July 2009.

SINGAPORE: The cash premium, or Cash-Over-Valuation (COV), for Housing and Development Board (HDB) resale flats has reached a four-year low.

According to the Singapore Real Estate Exchange (SRX) monthly flash report, overall COV dropped to S$18,000 in August, the lowest level since July 2009.

For the first time since 2006, SRX said HDB resale flat prices have fallen for the fourth straight month. Overall HDB resale prices slipped 0.7 per cent in August.

This can be partly attributed to the decline of cash premiums being paid for HDB resale flats.

The overall COV was S$20,000 in July. This fell by S$2,000 or 10 per cent to reach S$18,000 in August.

Some property analysts attributed this to the ramped up supply of new flats being launched by the HDB and the introduction of various loan restrictions like the Total Debt Servicing Ratio which was announced in June where only 60 per cent of one's income can go towards servicing a loan.

International Property Advisor's chief executive officer, Ku Swee Yong, said: "The downward trend of COVs is partly influenced by the new measures at the end of June called the Total Debt Service Ratio (TDSR).

"Many home buyers find that they are unable to borrow as much as expected, so it has affected the larger size resale HDBs a little bit more than the three-room and four-room HDB (flats).

"In fact, more young couples are probably shifting their sights down one notch -- instead of stretching themselves for a five-room resale or an executive resale, they're going after a four-room HDB."

According to SRX, executive flats in Punggol registered the lowest median COV of negative S$13,000, which means they are sold at S$13,000 below valuation.

Out of three transactions recorded, two were sold below valuation.

On the flip side, executive flats in Bishan saw the highest premium. The median COV was S$120,000.

Nicholas Mak, executive director of research and consultancy at SLP International Property Consultants, said: "There has been a huge supply of BTO flats offered in the Punggol area in the last two to three years.

"Because of that, it has drawn away potential buyers from the resale market to the BTO market. The BTO flats are all priced lower than the resale flat prices.

"While in Bishan area, it's still quite a popular area... there are a few very popular primary and secondary schools in the area. Furthermore, there is a very thin supply of new flats. As a result, it's still a seller's market in that town."

With tighter loan measures and home buyers being more cash strapped as a result, property analysts expect COVs to continue to trend downwards. They also expect more HDB resale flats to be sold without a cash premium, or at below valuation.

This is already starting to show. Zero-COV transactions made up just one per cent of all HDB resale transactions in January. This went up to 5.3 per cent in August.

As for resale transaction volume, flash estimates showed that while the numbers remained roughly the same in July (1,286) and August (1,280), this was a 29 per cent drop year-on-year.

Property analysts said this is likely due to more home owners choosing to rent out their HDB flats.

- CNA/fa

- wong chee tat :)

By Olivia Siong

POSTED: 06 Sep 2013 8:53 PM

The overall Cash-Over-Valuation for HDB resale flats dropped to S$18,000 in August, the lowest level since July 2009.

SINGAPORE: The cash premium, or Cash-Over-Valuation (COV), for Housing and Development Board (HDB) resale flats has reached a four-year low.

According to the Singapore Real Estate Exchange (SRX) monthly flash report, overall COV dropped to S$18,000 in August, the lowest level since July 2009.

For the first time since 2006, SRX said HDB resale flat prices have fallen for the fourth straight month. Overall HDB resale prices slipped 0.7 per cent in August.

This can be partly attributed to the decline of cash premiums being paid for HDB resale flats.